Texas Property Tax Code Offers Some Relief For Victims Of Latest Disasters

O'Connor highlights that the recent Texas Property Tax Code offers some relief for victims of the latest disasters.

HOUSTON , TEXAS , UNITED STATES , May 23, 2024 /EINPresswire.com/ --

Temporary Disaster Exemption Information: Texas property owners affected by recent weather disasters may qualify for substantial property tax relief for 2024. If the value of improvements is damaged by at least 15% by a disaster recognized by Governor Abbott, property owners qualify for a partial property tax exemption. This includes all types of property, residential commercial and business personal property that are at least 15% damaged by a disaster recognized by the governor. However, there are strict timelines to file and claim the disaster tax exemption. Expect the appraisal district to expect proof of the amount of damage.

2024 Tough Year for Weather Disaster in Texas

Many Texas property owners have been in for a rough ride so far in 2024. Weather related incidents have not been kind to the property owners in the state. Governor Greg Abbott issued a disaster declaration for 29 counties on April 30, which has since been amended three times. The most recent update was issued May 15, bringing the total to 98 of 254 Texas counties included because of hazards related to severe storms and flooding that have resulted in damage to both residential and commercial property. As many residents of Harris and Waller county may have noticed, this timeline does not account for damage incurred by the derecho storm that struck the city of Houston and surrounding metropolitan area on May 16, 2024, so many eyes are sure to be on the governor’s office to see if and when further amendments will be made to add the most recent devastation to the declaration.

Both Homeowners and Commercial Property Owners Qualify for this Property Tax Exemption

As homeowners and businesses suffer the financial pain brought on by these catastrophic events, there is a system in place to provide some measure of respite. Texas Tax Code has provisions in place to allow property owners to claim a temporary exemption for disaster damage. In order to qualify for the exemption, 1) the property must be located in a county declared a disaster area by the governor, 2) application for the exemption is due no later than 105 days after the county in which their property is located was declared a disaster area, and 3) sustained damage must be equivalent to 15% or more .

Does Your County Qualify?

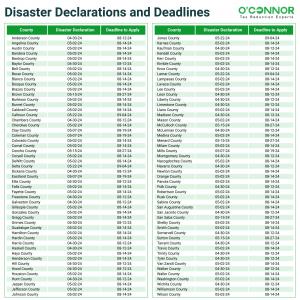

O’Connor has compiled a list of the 98 counties currently included in Governor Greg Abbott’s disaster declaration, along with the dates for when each county was added to the list, and the deadline for property owners in that county to apply for exemption.

Disaster Declarations and Deadlines

Because O’Connor is concerned about the safety, well-being, and financial security of property owners, we offer assistance to our clients, helping them to navigate the process of applying for temporary exemption for disaster damage. Whether or not you are a client, however, if you have incurred damage from these recent weather events, we encourage you to apply for the exemption.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ +1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.