ESG Engagements in 2024

Key trends to emerge from ESG engagements in 2023 and Q1 2024.

- As global regulators look to increase corporate ESG accountability, an increasing number of companies are identifying climate change as a risk in their corporate disclosures. In 2023, 76.2% of the 3,000 largest U.S. companies mentioned climate change as a risk in their 10-K reporting, up from 68.2% a year prior.

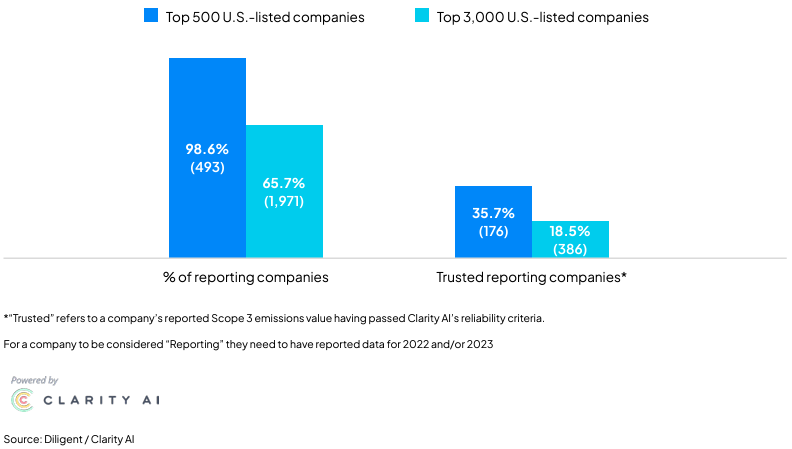

- Scope 3 emissions, derived from a company’s value chain, are becoming a standard part of U.S. corporate sustainability disclosures. Of the 500 largest U.S. companies, 98.6% voluntarily disclosed Scope 3 emissions in 2022 and/or 2023, while 65.7% of the 3,000 largest U.S. companies also provided such disclosure.

- As climate-related disclosure requirements make their way into statute, a new frontier is rapidly emerging as investors drive nature-related issues up the agenda. The 10 biodiversity proposals subject to a vote at S&P 500 constituents averaged 24% support in 2023, compared to 65 climate change proposals securing 21% support.

- 2024 investor policy changes placed an emphasis on director accountability and greater climate-related disclosure. Companies falling short of new minimum requirements could find their directors at risk of opposition, with shareholders looking to encourage individual accountability for ESG oversight.

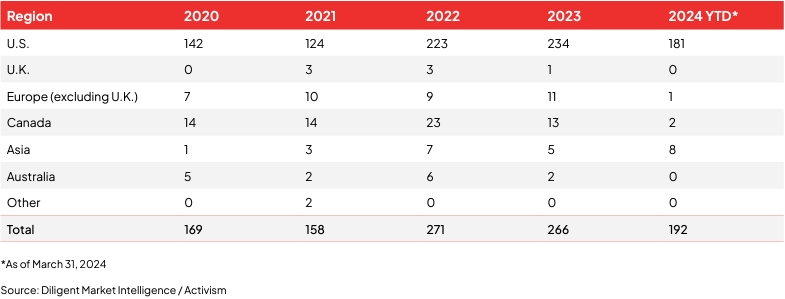

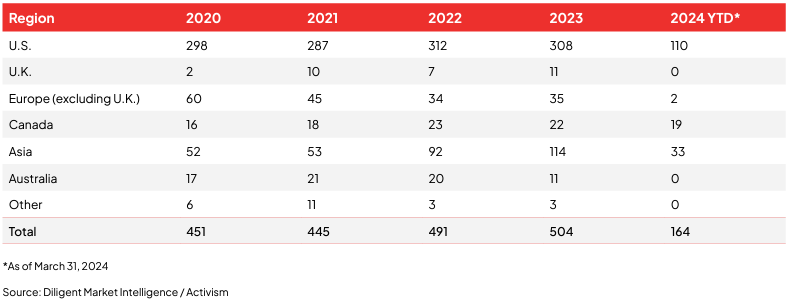

- In Q1 2024, 181 campaigns were launched at U.S.-based companies inclusive of social demands, more than double the 71 environmental campaigns launched in the same period and on track to exceed the 234 social campaigns launched throughout 2023. Labor unions are driving discussions concerning workers’ rights, with seven social campaigns launched globally involving labor unions in Q1 2024, the same number as in the entirety of 2023.

2024 marks a new frontier for climate reporting, with many companies facing their first calls for regulated disclosure. For companies already confident in their reporting, these developments serve as an opportunity to focus on oversight and materiality.

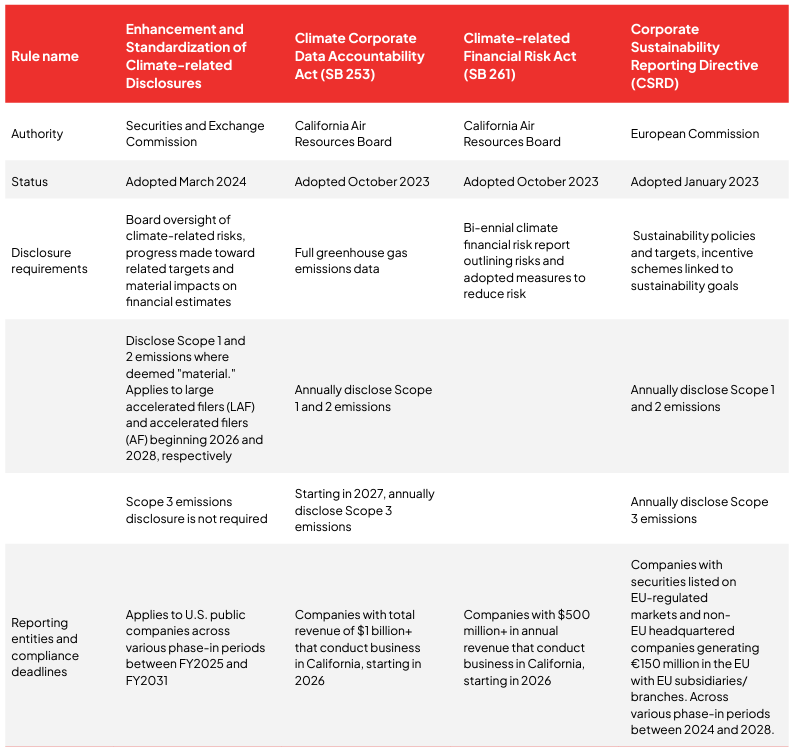

After two years in the making, the Securities and Exchange Commission’s (SEC) Climate Rule was approved in March, while 2024 marks the first data collection year for the European Commission’s Corporate Sustainable Reporting Directive (CSRD). The past year also saw California call on companies doing business in the state to report on climate risks and opportunities, starting in 2026.

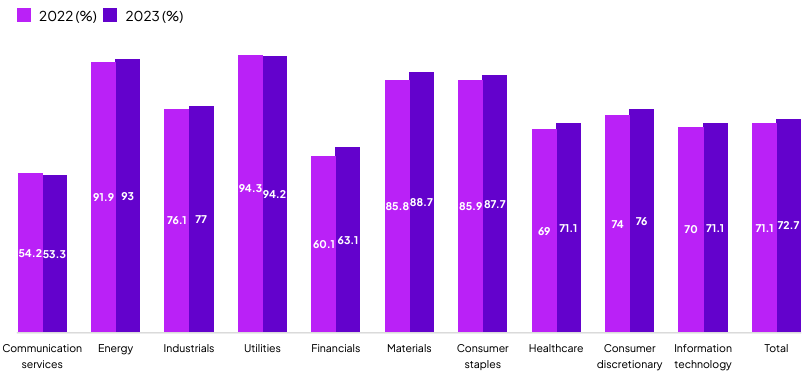

In 2023, 76.2% of the 3,000 largest U.S. companies mentioned “climate change” as a risk in the risk factor section of their 10-K filings, up from 68.2% a year prior. The number of companies to disclose “ESG,” “ESG reporting” or “environmental regulations” as a risk increased to 72.7% in 2023, up from 71.1% in 2022, according to Diligent Market Intelligence (DMI) data.

“We’ve been living with companies voluntarily providing this sort of disclosure for so long that it is easy to forget that it hasn’t been in effect in a regulatory context,” David Zilberberg, counsel, Davis Polk & Wardwell, told DMI in an interview. “There is certainly a lot of ramping up that companies are going to have to do to meet the new requirements and prepare for sustainability reports to face more scrutiny.”

What is required?

The SEC’s Enhancement and Standardization of Climate-Related Disclosures Rule requires disclosure of material climate-related risks that may impact the registrant’s business strategy, operations or financial conditions, as well as activities taken to mitigate climate risk, including the use of transition plans, scenario analyses or internal carbon prices. Companies with market caps of more than $75 million will also be required to provide Scope 1 and 2 reporting where deemed “material.”

California rule SB 253 calls on companies conducting business in the state to annually disclose Scope 1, 2 and 3 emissions. Companies will be required to strengthen their qualitative reporting under SB 261, which mandates large businesses operating in California to bi-annually disclose climate-related financial risks and mitigation strategies. It is expected these rules will affect upwards of 5,000 and 10,000 companies, respectively.

“California’s climate disclosure laws will be more far-reaching in certain respects than the SEC’s climate rules,” Paul Barker, partner at Kirkland & Ellis, told DMI in an interview. “Whereas SB 261 requires Task Force for Climate-related Financial Disclosures-aligned (TCFD) reporting, the SEC’s rules diverge from TCFD and require detailed f inancial statement disclosures.”

Europe’s CSRD, which calls on companies to disclose their impacts on the environment and related target setting, is estimated to impact 10,000 international companies, 3,000 of which will be based in the U.S. CSRD’s “double materiality” approach means companies must disclose information on the impacts of their business on the environment and society, irrespective of the positive or negative effects of such impacts on companies’ financials.

Despite varying approaches toward emissions reporting, Scope 3 disclosure is becoming the standard. Of the 500 largest U.S. companies, 98.6% voluntarily disclosed Scope 3 emissions in 2022 and/or 2023, while 65.7% of the 3000 largest U.S. companies also provided such disclosure.

How can boards prepare?

One key takeaway for boards is the need to strengthen and disclose their climate oversight policies and processes.

The SEC Climate Rule calls on companies to disclose board oversight of climate-related risks, management’s role in assessing and managing risks and how processes are integrated into broader risk management systems. Both California’s SB 261 and Europe’s CSRD draw on TCFD recommendations, seeking disclosure on processes and policies in place to mitigate climate risk.

On Diligent’s Corporate Director Podcast, Abbey Raish, Partner at Kirkland & Ellis’ ESG and Impact Practice, said boards should be asking themselves key questions concerning ESG oversight; “Who is responsible for this? Is it an individual, a committee or a task force? How is that group engaging with boards in these issues? Who is reporting up and how often are they reporting up?”

Proportion of the 3,000 largest U.S. companies to mention “climate change” as a risk in the risk factor section of 10-K filings

Director accountability and enhanced climate transparency were recurring themes in investor policy changes ahead of the 2024 season. Vanguard Group updated its U.S. and U.K. policies, stipulating that the $7.2-trillion asset manager may withhold support from directors “deemed responsible” where the board has “failed in its oversight role.”

“This again varies based on market and industry, but our clients typically expect to see boards outlining ESG oversight policies and processes in their governing documents,” Patrick Fiorani, research and engagement specialist at Glass Lewis, told DMI. “While boards often disclose the ESG topics discussed in board meetings, this does not necessarily mean they are a principal responsibility for the board.”

What constitutes decision-useful disclosure?

For companies looking to familiarize themselves with the new regulations and provide the information investors want, materiality is key. Providing robust and transparent reporting, both qualitative and quantitative, helps shareholders understand emerging risks and opportunities, as well as the steps companies are taking to minimize the impacts of these factors on corporate strategy or operations.

“Many of the disclosures contemplated by the final [SEC] rules are expressly tied to materiality,” Michael Littenberg, partner at Ropes & Gray, told DMI. “That’s great in concept, since it will enable registrants in many cases to exclude disclosures that they determine to be immaterial. On the flipside, registrants will need to go through the exercise of assessing materiality, which is sometimes easy but other times much harder.”

If companies haven’t already, now is the time to clearly define rules and responsibilities, ensuring a clear path for reporting up to the board. Once boards feel confident in their systems, they should engage shareholders to ensure that their disclosures adequately inform the market about the work that is being done.

Proportion of the 3,000 largest companies to mention “ESG,” “ESG reporting” or “environmental regulations” as a risk in the risk factor sections of 10-K filings

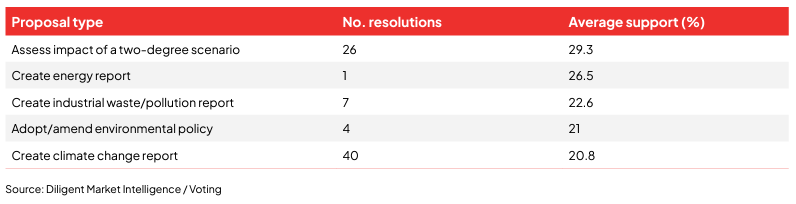

Highest performing environmental shareholder proposals at U.S.-based companies in 2023

Climate reporting regulations for U.S.-listed companies

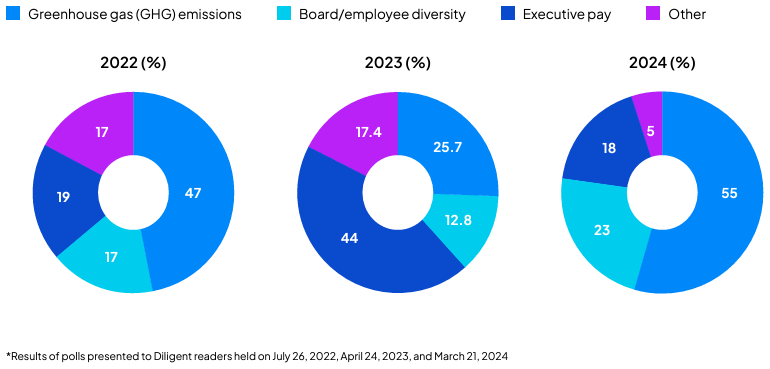

What do you think is the biggest ESG issue right now?

Climate change has become a priority concern, with 55% of respondents to a Diligent survey selecting greenhouse gas emissions as the biggest ESG issue in 2024, more than double the 25.7% seen a year prior.

Proportion of US companies to voluntarily disclose Scope 3 emissions in 2022 and/or 2023

As climate-related disclosure requirements make their way into statute, a new frontier is rapidly emerging as investors, regulators, and non-governmental organizations use the same playbook to drive nature-related issues up the agenda.

Amid the increased focus on corporate reporting, nature-related shareholder proposals are winning higher levels of support than their climate-related counterparts. The 10 nature proposals subject to a vote at S&P 500 constituents in 2023 averaged 24% support, compared to 65 climate change proposals securing 21% support.

“Concern over nature has been building for some time,” Andrew Shalit, shareholder advocate at Green Century Capital Management, told Diligent Market Intelligence (DMI). “It is a systemic risk, similar to climate change, but even more broad. Companies need to understand how they rely on nature and how they impact nature, and they need to share these assessments with the investment community.”

Putting the pressure on

As of April 30, five nature-related shareholder proposals have been subject to a vote this year globally, securing 16% average support, compared to 21 averaging 18.8% support throughout 2023, according to DMI’s Voting module.

Three proposals, seeking reporting on pesticide and/or water use, have won above 20% support.

Consumer defensive industries are bearing the brunt of demands for enhanced biodiversity reporting and commitments. In an interview with DMI, Patrick Fiorani, research and engagement specialist at Glass Lewis, noted that companies involved in commodities production often face calls “to enhance reporting around biodiversity, deforestation and labor rights, while ingredient and food manufacturers tends to face requests for supply chain reporting.”

Since the start of 2023, eight (44.4%) of the 18 nature proposals voted on globally have been directed toward the consumer defensive sector. 2024 proposals asking Dow to report on plastic use and Barrick Gold to commission a water impact report received 26.3% and 25% support, respectively.

Conscious of the growing demand for biodiversity disclosure among shareholders, more consumer defensive companies are proactively strengthening their reporting. In March, U.S. food giant Kellanova, formerly known as Kellogg, committed to report on its impacts on the natural world, while a month later ADM released a third-party assessment on deforestation, both following engagement with Green Century Capital Management.

A busy year for standard setters

While corporate nature-related disclosures are largely voluntarily and unstandardized, this is set to change, thanks to emerging reporting frameworks by well-established and trusted ESG reporting authorities. Both the Taskforce on Nature-related Financial Disclosures (TNFD, following the Taskforce on Climate-Related Financial Disclosures, or TCFD) and the Science Based Targets Network (SBTN) published recommendations for corporate biodiversity reporting in 2023, while the International Sustainability Standards Board (ISSB) revealed in April its intention to research and potentially develop establish biodiversity-related reporting standards.

“In areas such as biodiversity, distinguishing leaders from laggards can be challenging because there is not a consensus on how to measure related impacts,” Fiorani told DMI. “We expect to see a firming up of targets and disclosures soon, thanks to emerging frameworks like TNFD and SBTN.”

“The release of TNFD and SBTN are an important signal about the importance of comprehensive disclosure of nature impacts and dependencies,” Shalit said. “They help companies produce reports that are comprehensive and comparable to each other. It will take time for these reporting frameworks to evolve, and for companies and investors to best learn how to use them but companies can get started now.”

TNFD published its recommendations in September 2023, providing a risk management and disclosure framework for nature-related impacts, dependencies, risks and opportunities. Among other things, TNFD recommends companies disclose metrics and targets used to assess and manage material risks and disclose the effects of nature-related dependencies and impacts on business strategy and financial planning.

320 companies across 46 countries have committed to start making TNFD-aligned disclosures by 2025, including Bank of America, Moody’s and Standard Chartered.

In April, the International Sustainability Standards Board (ISSB) also revealed it is commencing research on naturerelated risks and opportunities, with the view to establish a voluntary corporate reporting framework, drawing from TNFD guidance.

SBTN is also in the first stage of a multi-year plan to provide companies with science-based targets for nature. The guide provides insight on sector-level materiality assessments and target-setting, with additional guidance governing disclosures expected in 2025.

“I would recommend that companies begin with one portion of their supply chain. Use a framework that is close to what they are familiar with – so if they currently use TCFD, they could use TNFD for nature reporting – and apply that framework to one component of their supply chain,” Shalit told DMI. “Running pilots will help them understand the framework, and how to begin putting nature management into their company governance, operations and risk assessment.”

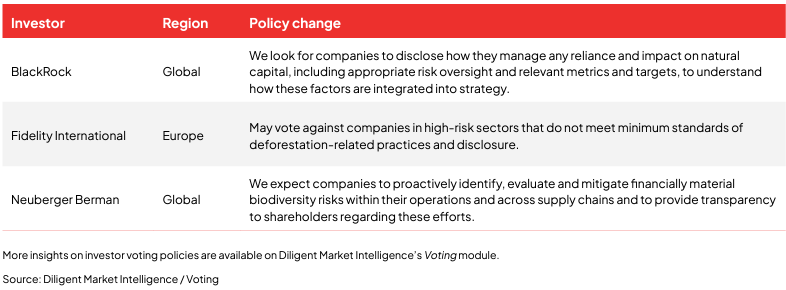

Nature-related voting policy updates in 2024

Nature-related voluntary reporting frameworks

By the end of Q1 2024, Diligent Market Intelligence (DMI) added 270 new investor policy documents to its Voting module ahead of the 2024 season, many of which indicated a move to enhance director accountability for ESG concerns and push for greater climate-related disclosure.

“Investors expect boards to manage risks related to an array of issues like climate change, human capital management and cybersecurity, so when they consider there’s a lack of oversight of these material items, they are increasingly communicating discontent through director votes,” Alliance Advisors’ Managing Director Etelvina Martinez told DMI in an interview. “Some investors are also using vote-no campaigns to gain traction on certain items and we’re seeing more of them as advocacy groups organise vote-no’s on ESG issues.”

In its 2024 policy update, Vanguard revealed it may withhold support from “responsible” directors where the board has “failed in its oversight role.” The New York State Comptroller similarly announced that it will withhold support from audit committee members when the company fails to “disclose and appropriately manage” climate risks.

Where a company has not responded adequately on climate or human capital concerns, Amundi Asset Management revealed it may now vote against the company’s chair. The $2-trillion asset manager also now expects companies to disclose “comprehensive” targets, baseline figures and scenarios across Scope 1, 2 and 3 emissions.

For the first time this year, Glass Lewis will look for robust sustainability disclosure at S&P 500 and FTSE 100 companies operating in industries where the Sustainability Accounting Standards Board (SASB) has determined that emissions represent a financially material risk. Glass Lewis will look at companies in markets outside the U.S. and U.K. as well. Such disclosures should align with Task Force for Climate-related Financial Disclosure (TCFD) recommendations and outline board-level oversight responsibilities. When TCFD disclosure and clear disclosure concerning board oversight of climate is lacking, we will generally recommend against members of the board, it said.

Consequences for noncompliance

Companies falling short of new minimum requirements could find their directors at risk of opposition, with shareholders looking to encourage individual accountability for ESG oversight.

One such example arose at AO Smith’s April 9 annual meeting, where directors Ilham Kadri and Victoria Holt received 66.8% and 55% opposition to their re/elections, respectively. In its rationale, the State Universities Retirement System of Illinois cited the U.S. industrial company’s failure to provide SASB-aligned reporting.

In March, Woodside Energy Chair Richard Goyder found himself the subject of a withhold campaign, after HESTA suggested a board refresh to ensure the Australian energy giant is “well-placed for a low-carbon future.” Goyder’s reelection faced 16% opposition, while the company’s climate plan was rejected by 58% of votes cast.

And driven by declining support for non-binding shareholder proposals, some ESG advocates are focusing on opposing director elections. A test case against ExxonMobil, which sued Arjuna Capital and Follow This for filing a climate-related proposal, was due to climax on May 29.

“We have been very actively working in our one-to-one advocacy with investors to promote director no-votes as a tool we should all be deploying a lot more freely than we are and not shying away from it because of notions of gentility,” Sara Murphy, chief strategy officer at The Shareholder Commons, told DMI. “There is a plausible future, at least in the U.S., of a dismissal of Rule 14a-8, the very mechanism by which we file shareholder proposals in this country, and I think some people are reading the tea leaves and realising that we ought to be prepared for being forced to use other strategies.”

Clear communication between shareholders and directors remains key to ensuring both parties understand what is expected and what is being done about ESG concerns.

“You make sure that your company is working within the guardrails that investors define to protect their diversified portfolios and you’ll have no problem,” Murphy warned. “We are doing our very best to make sure that our expectations are clear and transparent, so there is no guesswork for boards as to what’s expected of them.”

“Staying ahead of potential issues and having regular engagement with your top shareholders are really important things” for boards, Martinez advised. “Also being open to engagement with some of the smaller shareholders and stakeholders because, often, they are the ones that are at the forefront of emerging issues. Make sure you evolve your disclosures because it’s always a moving target. There’s always something new to keep your shareholders apprised of.”

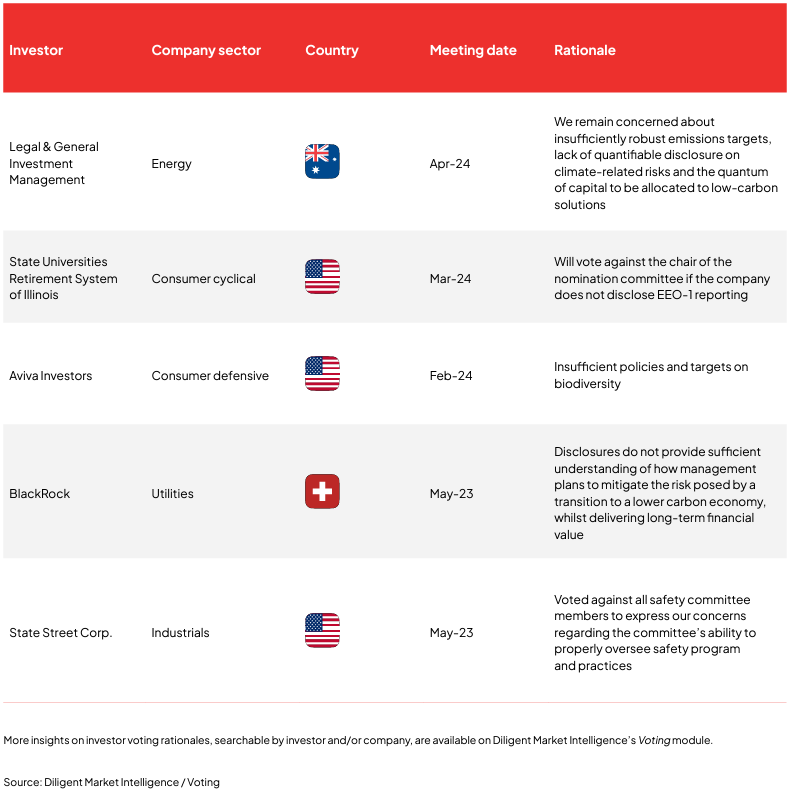

Common terms in voting rationales for director no-votes

When justifying votes against U.S. director elections, shareholders commonly cite insufficent ESG-related disclosure or a lack of climate-related target-setting.

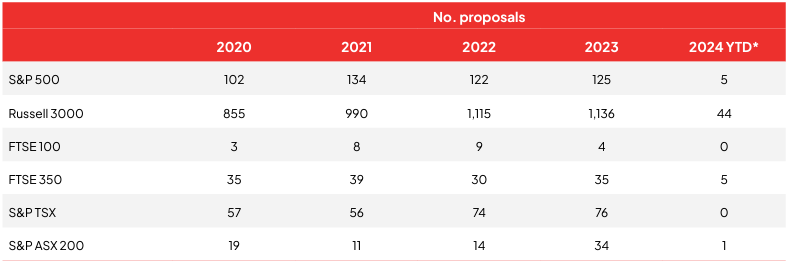

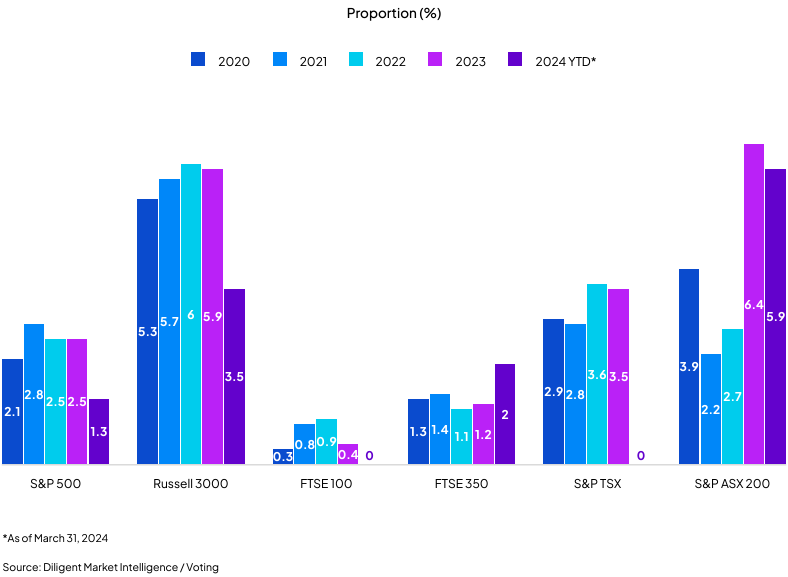

No. and proportion of director re/election proposals to receive less than 80% support by index

Sample voting rationales for ESG director no-votes

Amid cost-of-living concerns, shareholders have enhanced their focus on workers’ rights, prompting an increase in human capital-related demands. In Q1 2024, 181 campaigns were launched at U.S. companies inclusive of social demands, more than double the 71 environmental campaigns in the same period. Just 234 social campaigns were launched throughout 2023 at U.S.-based companies.

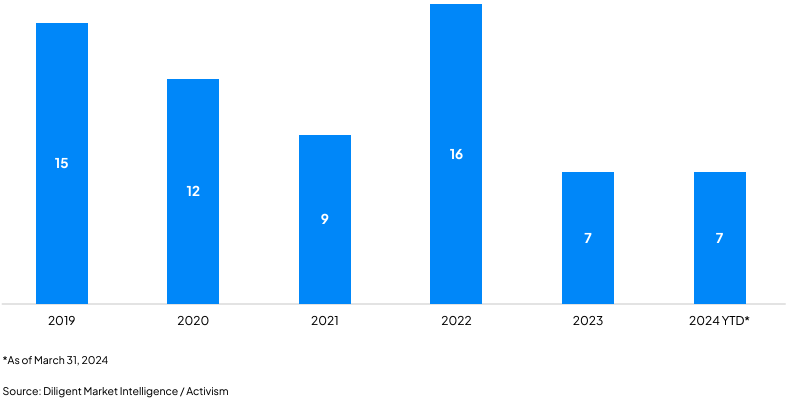

Labor unions are playing a bigger part in driving companies to enhance workers’ rights and freedoms, both launching proxy contests and filing shareholder proposals this season. In Q1 2024, seven social campaigns were launched globally involving labor unions, the same number as in the entirety of 2023, according to Diligent Market Intelligence’s (DMI) Activism module.

“In recent years, there has been a massive shift in the employee-employer relationship, largely accelerated by COVID-19,” Geoff Serednesky, founder of Fishbone Advisors, told DMI. “Many of these trends were directionally occurring before the pandemic but intensified due to the changing workplace environment. Labor unions have become more involved as public awareness has increased around social justice issues, aging workforce demographics and the importance of worker rights.”

Adopting the activist toolkit

Among the most high-profile human capital campaigns of 2024 was SOC Investment Group’s proxy contest at Starbucks, aimed at remedying what the labor coalition described as the U.S. coffee giant’s “severe human capital mismanagement.” Less than a year prior, a shareholder proposal seeking a workers’ rights assessment secured 52% support.

SOC’s campaign did not go all the way to a vote, the union pulling its nominees after Starbucks established a new ESG oversight committee and agreed to work toward providing employees with collective bargaining rights.

“More companies are willing to have a conversation on these topics,” Edgar Hernández, assistant director of Service Employees International Union’s (SEIU) strategic initiatives department, told DMI. “In some cases, companies understand you’re not singling them out, there is a legitimate concern that could pose a risk for investors that merits further consideration. In some cases, companies are willing to meet and engage in a discussion and that can be productive. And that, I believe, is a good thing for the company and investors.”

Richard Clayton, research director at SOC, told DMI that the Starbucks campaign demonstrated that campaigns with an ESG lens have the potential to “present a very credible case to shareholders and get boards of directors and senior management to change their minds, as a consequence.”

Labor unions also played a pivotal role in another of 2024’s highest-profile activism campaigns, in which Ancora Advisors secured three board seats at U.S. railroad operator Norfolk Southern.

While labor unions have historically not been vocal about third-party activist campaigns, the Brotherhood of Maintenance of Way Employes Division and the Brotherhood of Locomotive Engineers and Trainmen advocated for Ancora, believing change to the company’s leadership is the best path forward for its members. In contrast, the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO) endorsed Norfolk Southern’s management team, believing the activist’s proposed strategy is “not fit for purpose.”

Requests for enhanced reporting

Both labor unions and institutional investors have also seen success with shareholder proposals seeking to enhance workers’ rights. As of April 30, the three proposals subject to a vote at U.S.-listed companies seeking reporting on freedom of association and collective bargaining have secured 34.2% average support. Eight similar proposals secured 35.8% average support throughout 2023.

AFL-CIO’s proposal seeking a party assessment of Warrior Met Coal’s workers’ rights policies secured 46% support at its April 25 annual meeting, despite being opposed by management. A similar proposal won 30.6% support at Wells Fargo’s April 30 annual meeting.

“It’s important for shareholders to look at the reputational risks associated with human rights violations; I think investors are learning more about these issues and, in some instances, they are willing to take action.” Hernández said.

Regulations may also be advancing investor engagements on human capital. The Corporate Sustainability Due Diligence Directive (CSDDD), approved in European Parliament in April, requires non-EU companies generating upwards of 450 million euros in turnover in the EU to develop due diligence assessments governing human capital-related risks. U.S. companies doing business in Europe will also be required to disclose steps taken to identify and mitigate human capital-related risks in their own operations, as well as those of their suppliers and business partners.

“I think [human rights] has moved from being, at best, a marginal concern to being something that many, many investors – even those that don’t have any particular connection to the labor movement – recognize as something that they have to take seriously in a way that they potentially did not a decade or so ago,” Clayton said.

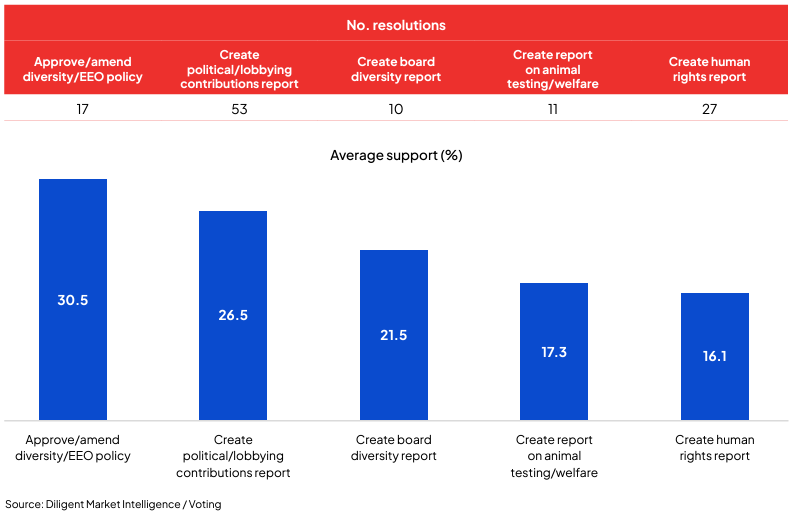

Highest performing social shareholder proposals at U.S.-based companies in 2023

No. social campaigns involving labor union(s) globally, by campaign start year

No. social campaigns involving labor union(s) globally, by outcome year and success

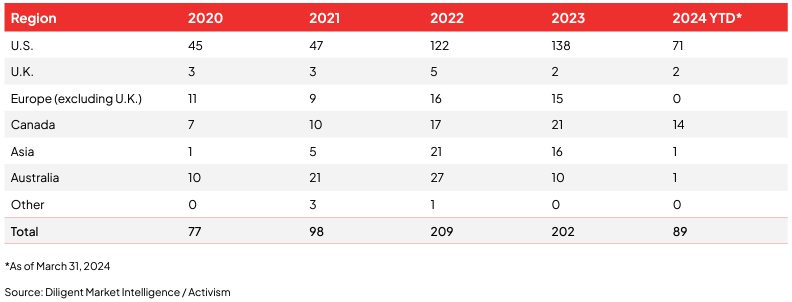

Regional breakdown of activist campaigns launched inclusive of environmental demands

Regional breakdown of activist campaigns launched inclusive of social demands

Regional breakdown of activist campaigns launched inclusive of governance demands

Key findings

Nearly 96% of directors expect a continued or stronger focus on ESG in the next five years

How do you envision your organization’s sustainability efforts changing over the next five years?

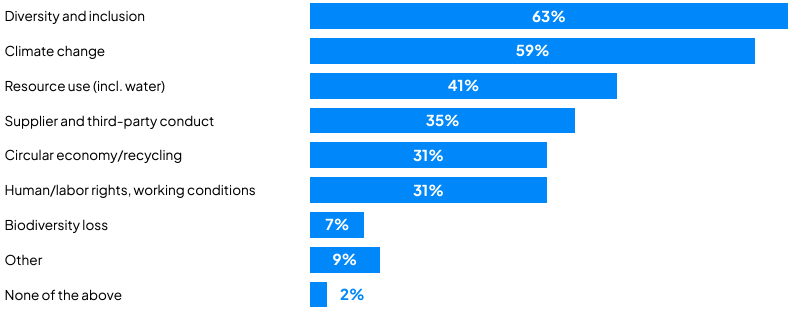

Diversity & inclusion and climate change top the list of ESG priorities for directors

What are the top three most important sustainability issues for your organization’s business strategy?

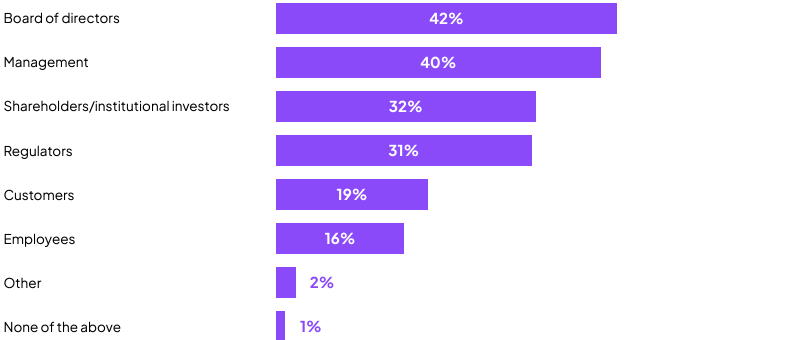

Shareholders rank in the top three biggest drivers of sustainability strategy adoption

Which of the following groups are the biggest drivers of adoption of a sustainability strategy at your organization?

Greater transparency is the top response to ESG legislation

What actions is your board taking in light of current or upcoming regulatory requirements related to ESG issues?

The full report is available to read here.

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.